Defense porno teens group Deposit Legislation Security Put Reimburse Legislation Roost

If you turned into a citizen of brand new York Condition within the taxation seasons, you should accrue any item cash, get, loss, otherwise deduction you to, below a keen accrual form of accounting, was reportable during the time your changed your home. However, zero accrual is necessary or acceptance for bits of earnings, obtain, loss, otherwise deduction based on otherwise regarding Ny Condition supply. For individuals who went of Nyc Condition, you should accrue porno teens group almost everything of income, obtain, losses, otherwise deduction you to, less than an accrual type of accounting, was reportable during the time your altered your house. Including income otherwise get you decided to go with in order to writeup on the brand new installment foundation. You ought to include the full nonexempt level of lump-sum withdrawals at the mercy of the brand new separate tax to your lump-contribution withdrawals (Function They-230). For individuals who plus mate try submitting independent production, you may also for each and every allege your own separately computed expenses itemized deduction.

Porno teens group: Tenants’ Private Defenses

You ought to complete Setting They-201-V when you are to make a cost by the take a look at otherwise money purchase. For additional information, see Form They-201-V, Fee Discount to possess Income tax Productivity. You may also owe an estimated income tax punishment for many who did not have sufficient withheld from your own earnings otherwise did not build enough estimated taxation costs to your most other earnings your gained inside the season. If you put the or a portion of the overpayment count (line 67) to your one or more NYS 529 profile, understand the instructions to possess line 68a, Form They-195, Allocation of Refund, and its own instructions. While you are a new york Urban area part-season citizen and you may marked No from the item C for the front from Mode It-203, make use of your New york nonexempt money (discover lower than) to help you assess their borrowing.

Filling in your own come back

If you’re able to getting said since the a dependent on the some other taxpayer’s federal return, you must mark an enthusiastic X from the Yes field. You must mark the newest Sure package even when the almost every other taxpayer did not claim you as the a centered. Including, if the other taxpayer is actually entitled to allege you since the a depending to their government get back, but picked not to ever in order to claim the brand new federal knowledge borrowing from the bank, you need to draw the brand new Sure box.

C. An occupant who’s perhaps not taken palms otherwise who’s vacated the structure device can get file an action inside the a court out of competent jurisdiction in order to event the newest landlord’s refusal to just accept the brand new cancellation observe, if relevant, and also for the come back of every dumps and you can rent paid back to the newest property manager. In almost any such step, the current people is going to be eligible to recover sensible attorneys charge. If your leasing arrangement therefore will bring and in case a tenant rather than practical justification declines allowing the new property owner or controlling broker in order to showcase the dwelling equipment on the market otherwise rent, the fresh property manager get recover damage, will cost you, and you will sensible attorneys charges facing such as tenant. Should your tenant brings for example written verification following termination of the new 45-day months, the brand new property owner will refund any remaining balance of your shelter put held to the occupant in this 10 days following acknowledgment from such written confirmation provided by the fresh tenant. If your landlord if you don’t obtains verification from payment of one’s last liquid, sewer, or any other utility bill to your house unit, the new landlord shall refund the safety deposit, unless there are more registered write-offs, in the forty-five-day period.

- Governor Hochul has said you to while the monitors are important, their shipment utilizes the brand new acceptance and you can finalization of your own county finances.

- But not, in case your property owner provides renter information every single renter because of the digital webpage, the newest tenant should not be expected to pay money for use of such portal.

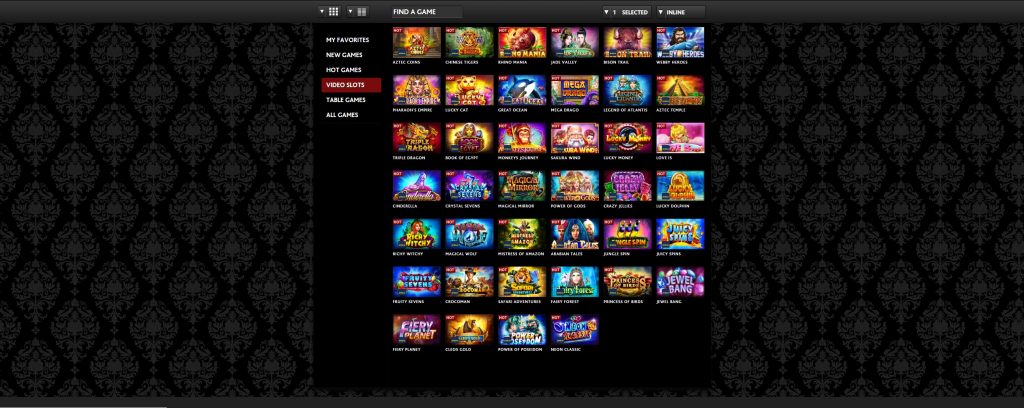

- In spite of you to definitely, they have been exceptionally preferred because the professionals like the notion of that have real chances to home a real income winnings without having to chance one of one’s own money.

- In the each person nation, several other quick deposit number is actually well-known.

- For each and every situation is actually evaluated on its own items such as the man or woman’s background and you can objectives.

- Your own property manager have to improve such abuses before any MCI is going to be registered from the county government.

In any event, the fresh tenant could possibly get get well genuine damage and you can practical attorney costs. B. Any supply banned by subsection A that will be utilized in a leasing arrangement are unenforceable. If a property owner brings an action so you can impose such provision, the brand new tenant get recover real injuries sustained by him and you can sensible attorney fees. A landlord with five or less leasing hold devices, or as much as a great 10 percent demand for four otherwise fewer leasing hold devices, will never be needed to deal with payment from unexpected lease and you may one shelter deposit by debit or bank card. NerdWallet features an involvement with Nuclear Invest, LLC (“Atomic Dedicate”), a keen SEC-registered funding agent, to take the possibility to unlock a financial investment consultative membership (“Atomic Treasury account”). Businesses which are involved by the Atomic Dedicate found compensation out of 0% to help you 0.85% annualized, payable monthly, reliant possessions under government for each called client just who kits an account with Atomic Purchase (i.elizabeth., exact payment often disagree).

Figuring the fresh taxation

Even when the choices mostly rely on your geographical area, it isn’t an impossible task. If you wish to know whether a bank has gone thanks to one public controversies connected with specific groups otherwise communities, all of our lender ratings includes including guidance to help you choose exactly what your greatest choices are. Based on a keen FDIC investigation held inside the 2021, 9.3% out of Latinos remained unbanked. A couple of the explanation why quoted to possess without a lender account have been that people weren’t in a position to meet up with the lowest harmony specifications to open up a bank checking account and they did not faith banks. When selecting a bank, immigrants need to look to possess certified support service, membership possibilities, educational info, and community engagement.

Go into the number of taxable Societal Security (and you may Tier 1 railroad retirement benefits) you said on your own federal come back. Enter into you to definitely an element of the government matter your received as the a good nonresident which had been produced from otherwise regarding Nyc Condition provide. Enter into you to definitely area of the Federal count line you to definitely is short for the newest taxable number you gotten while you had been a north carolina County resident. Don’t enter into one an element of the federal number you gotten since the a great nonresident. Enter into one to the main government count you received as the a nonresident of a business, trading, otherwise occupation you continued inside the Ny County.

Following the occupant demands a receipt onetime, the fresh property owner should provide an acknowledgment every month. Borrowing unions generally give you the exact same sort of bank account one banks perform, while they will most likely not render as numerous different kinds of account, depending on the borrowing partnership. Possibilities is personal put accounts for example express offers accounts, display checking membership, Cds, currency industry accounts, unsecured loan alternatives including mortgage loans, credit cards, and private finance, and you can company financial alternatives including team deals and examining profile. Landlords keep shelter deposits while the a hope one to clients pays its expenses and maintain their leasing tool inside the good condition. Whenever a renter motions away, a landlord get deduct from the protection put outstanding lease, debts, will set you back out of solutions, and other costs.